The global spread of COVID-19 is causing a decline in consumption and changes in consumer purchasing behavior.

Business economic activities are stagnating, and the environment differs considerably from our initial expectations.

Given such circumstances, on May 12, 2020 the Company withdrew its consolidated forecast for the fiscal year ending December 31, 2020.

A new forecast was disclosed on August 6, 2020 on the second quarter results announcement

and November 10, 2020 on the third quarter results announcement,

but these changes have not been reflected on this page. Please refer to the link below for details.

- Home

- INVESTORS

- Medium-to-Long-Term Strategy

- Medium-to-Long-Term Strategy

VISION 2020 ROADMAP

Shiseido is currently working on its medium-to-long-term strategy VISION 2020.

We have implemented various reforms aiming to “Be a Global Winner with Our Heritage.”

In 2018, we announced the Three-Year Plan, which is now in progress.

VISION 2020

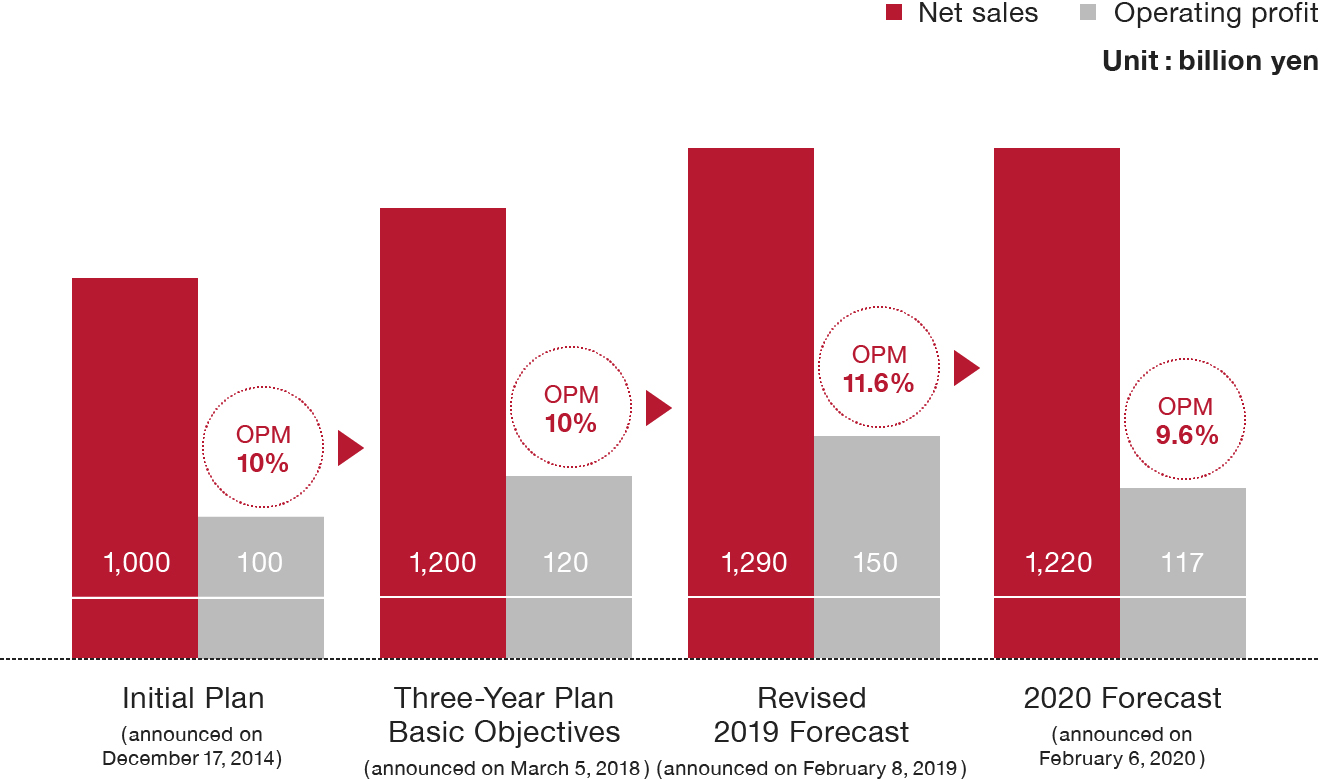

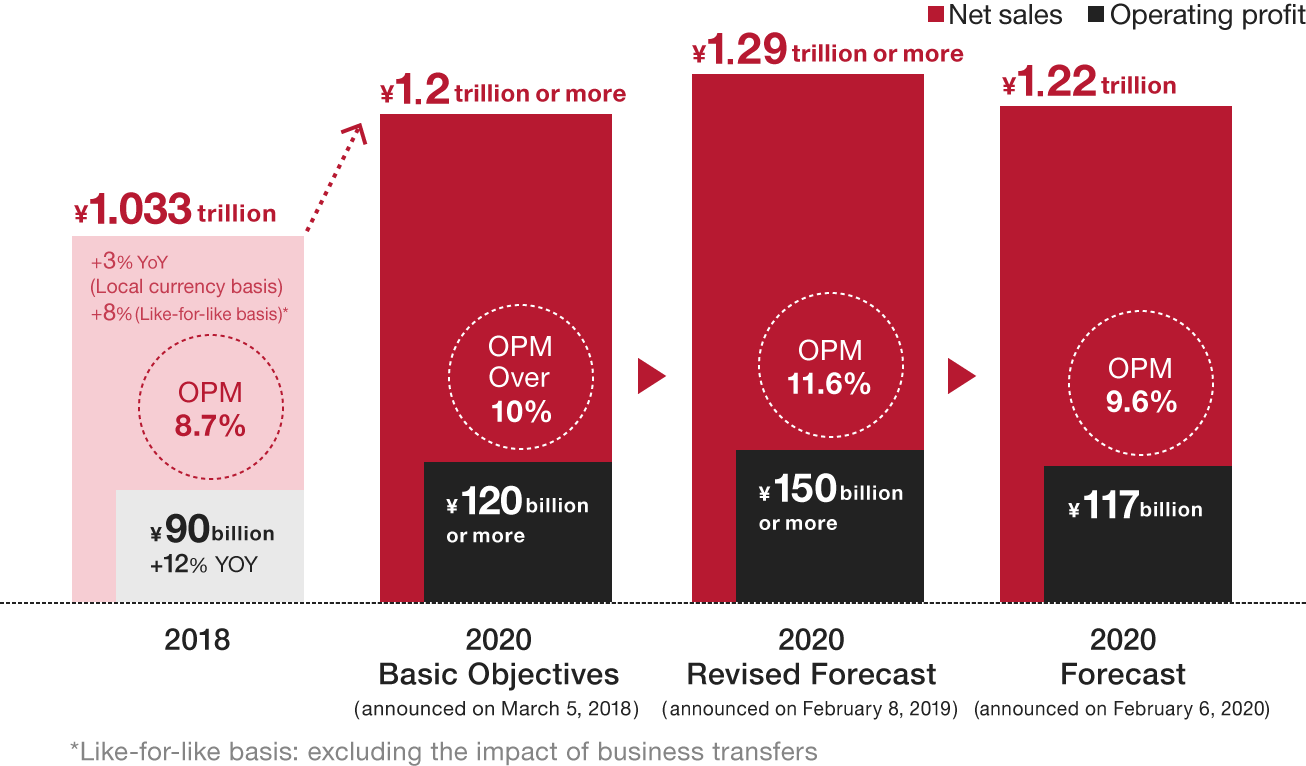

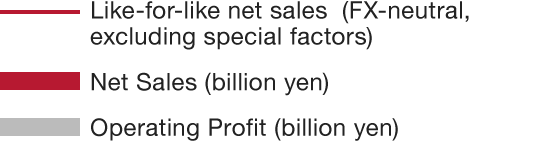

In December 2014, when we announced VISION 2020, the initial target was to surpass 1 trillion yen in net sales, with operating profit exceeding 100 billion yen.

However, we achieved sales of 1 trillion yen in 2017 and 100 billion yen in operating profit in 2018, three and two years ahead of schedule respectively.

Given the results through 2019, we announced our revised forecast for 2020 on February 6, 2020.

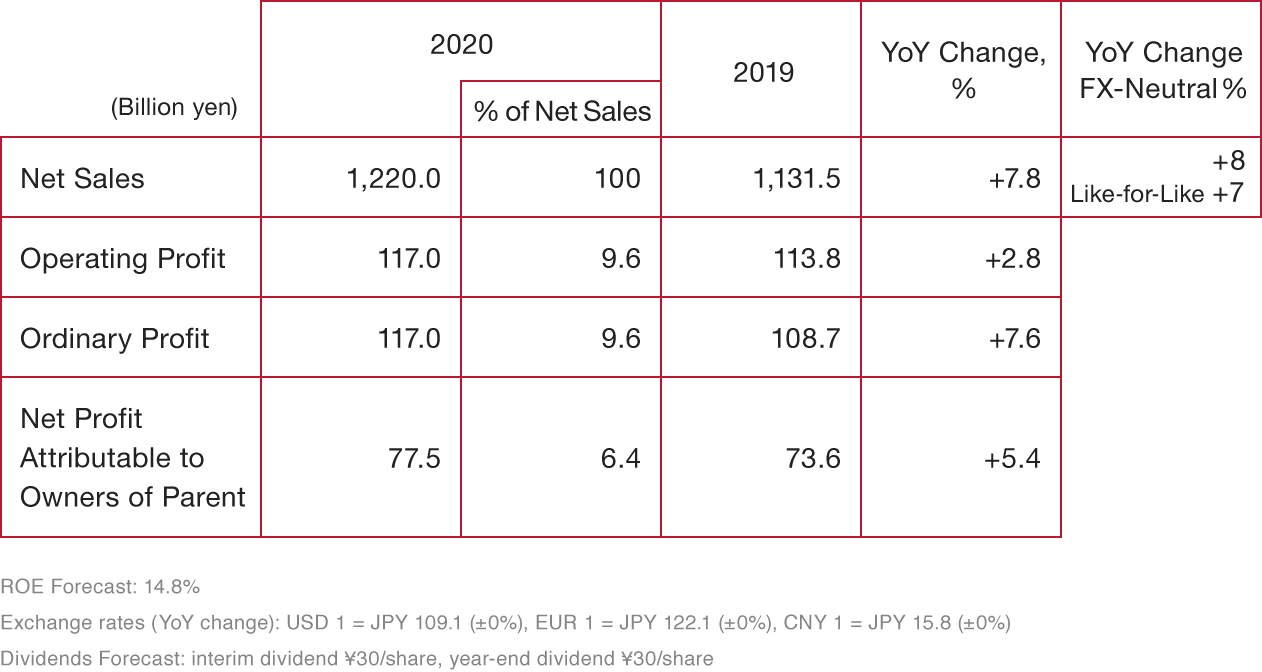

Our current forecast is net sales of 1,220 billion yen, operating profit of 117 billion yen, and an operating profit margin of 9.6%.

The current forecast excludes the impact of the novel coronavirus, as we are still evaluating its effect on our business.

VISION 2020 Background of VISION 2020Facing reality

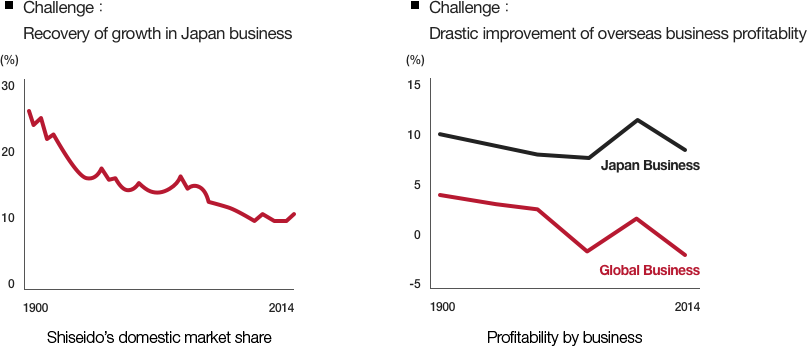

In 2014, when we formulated the VISION 2020 medium-to-long-term strategy, Shiseido's growth potential had deteriorated, sales growth was flat and operating profit was in continued gradual decline. So, first, we looked at the current situation and identified issues to be resolved at the fundamentaly.

What became clear, from listening to various voices regarding issues faced by Shiseido, was the harsh reality that we were not keeping up with consumers and market changes.

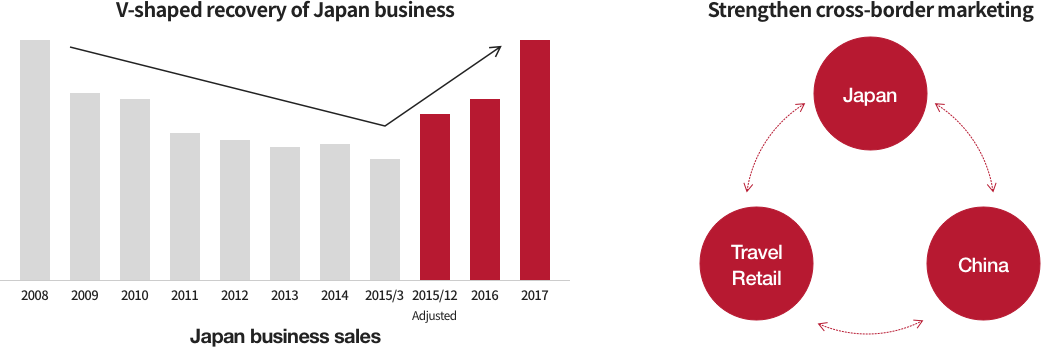

In order to overcome this situation, we set two essential resolutions. First, regain the growth of the Japan business. The Japan business, which previously represented about half of sales, declined in sales and lost market share for many years. As a result, even if overseas business sales expanded, the company as a whole could not grow. Recovering growth in the home market of Japan was a matter of urgency.

Second, improve overseas profitability. In the overseas business, low profits continued while investment to expand sales was moving ahead. To raise profitability throughout the company, it was necessary to both grow the overseas business while simultaneously enhancing profitability.

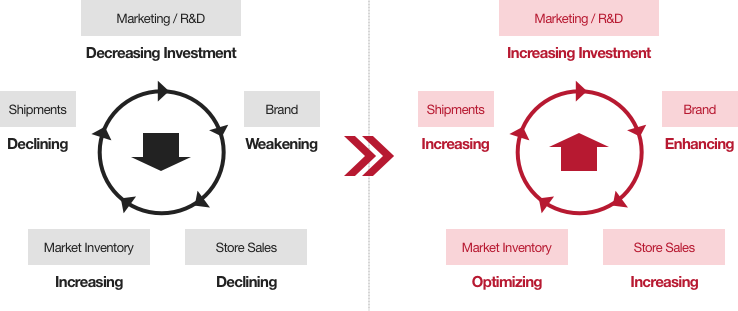

The main reason behind the decline in growth potential had been a reduced investment in marketing and R&D necessary for strengthening brands and businesses. As a result, brand equity became weaker, store sales declined due to a decrease in consumer purchasing, and our company’s shipments slowed down accordingly, feeding a vicious cycle of deteriorating profitability.

To tackle this situation, Shiseido launched its VISION 2020 medium-to-long-term strategy, in order to regain growth and ensure that the company remains vital for the next 100 years.

VISION 2020 Basic strategy and first three years

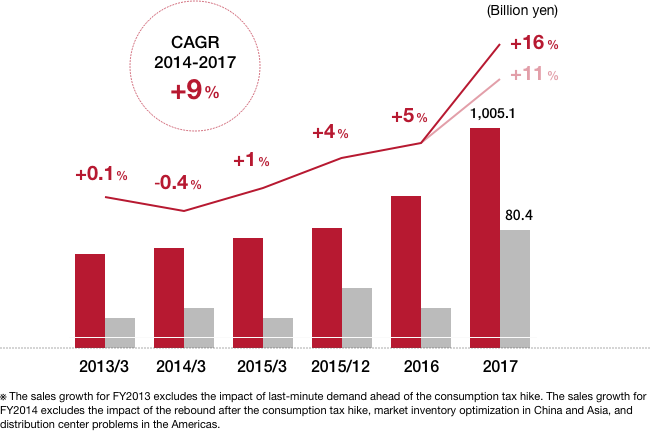

VISION 2020 ROAD MAP In the VISION 2020 medium-to-long-term strategy, we are determined to “Be a Global Winner with Our Heritage.” In order to achieve this, we set the three years from 2015 to 2017 as a period to “Rebuild the Business Foundation” and the three years from 2018 to 2020 as a period of “New Strategy to Accelerate Growth.” In other words, based on the strong business foundation built in the first three years, we plan to grow significantly in the next. For 2020, we set a target of 1 trillion yen in net sales, and operating profit of 100 billion yen.

Towards enhancement of brand value

The key concept of VISION 2020 is to enhance brand value.

Brand value will be ensured by marketing and innovation combined with able execution by people and organizations. We are focusing on initiatives that enhance both our corporate brand and product brands.

Major efforts in the first three years (2015-2017)

For the first three years from 2015 to 2017, we implemented various reforms to rebuild our business foundation. Activities are divided into two broad categories. The first is "cleaning up legacy issues" that we had not dealt with over the past, and the second is "building a virtuous cycle" to establish a growth trajectory. In particular, we have focused on the following three strategies for building a virtuous cycle to stimulate the growth momentum that had stalled.

1. Prestige first

We strive to strengthen our global presence by prioritizing prestige brands, which are our strength. Through selection and concentration of brands in which we invest, we will achieve growth that exceeds the market.

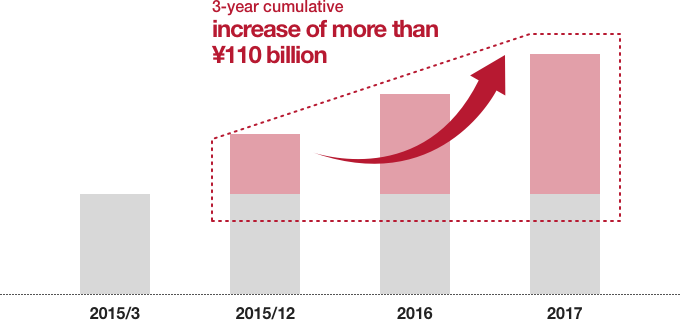

Along with this, cumulative marketing investment has been increased by 110 billion yen from 2015 to 2017, to support brand growth. In order to generate the capital for this growth investment, we have worked on cost structual reform throughout the entire company and reduced total costs by over 60 billion yen in three years..

2. Build a global management structure

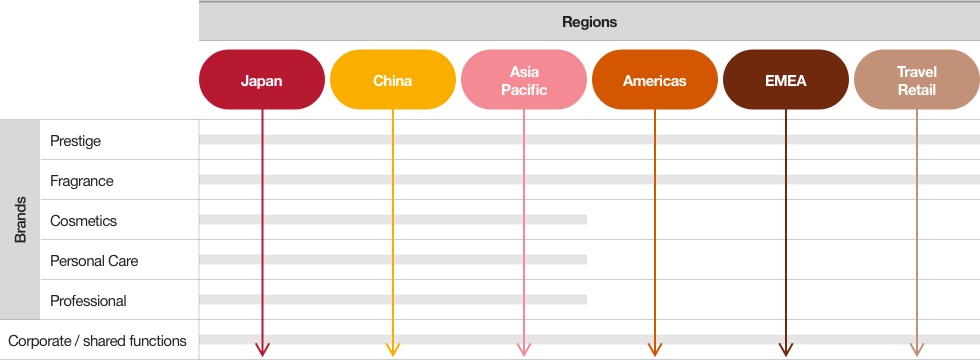

From 2016, we have functioned as a global matrix organization that integrates six regional headquarters and five brand categories.

We delegate wide-ranging responsibilities and authority to the CEOs of each regional headquarters, and based on the concept of “Think Global, Act Local,” increase marketing activities appropriately to each region and their ability to respond to market changes to meet the needs of local consumers, and carry out suitable and agile decision-making.

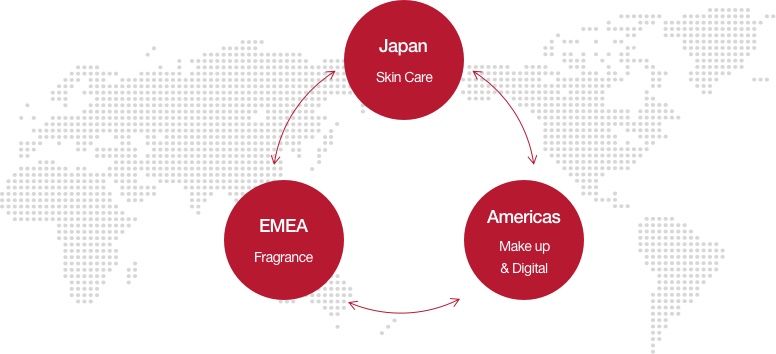

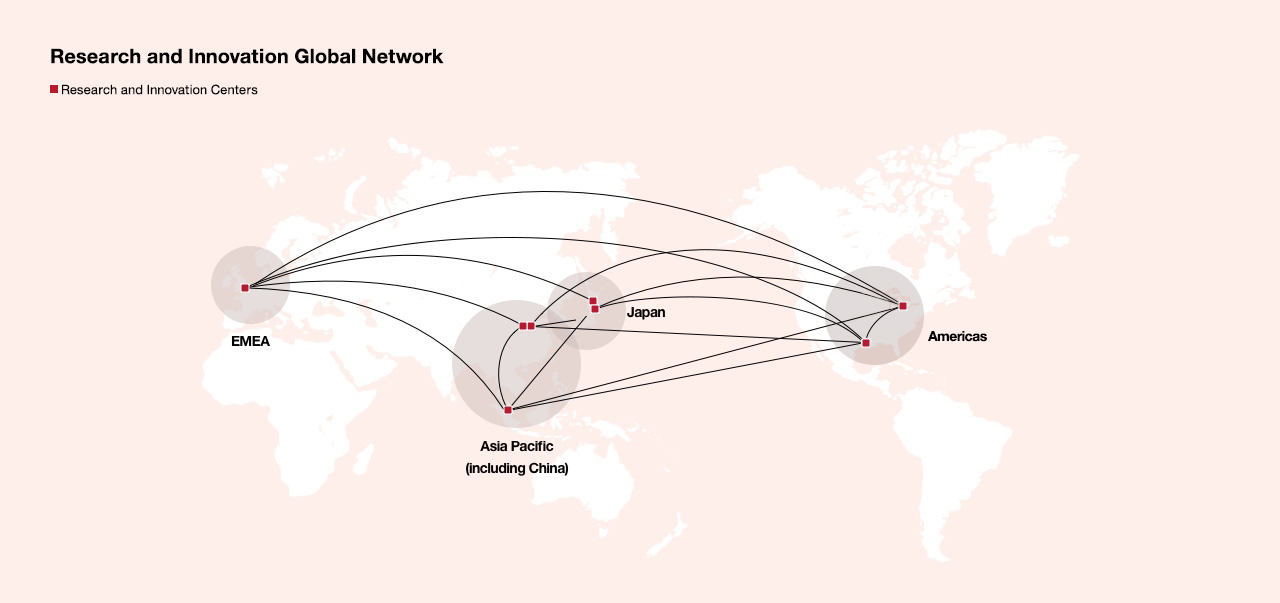

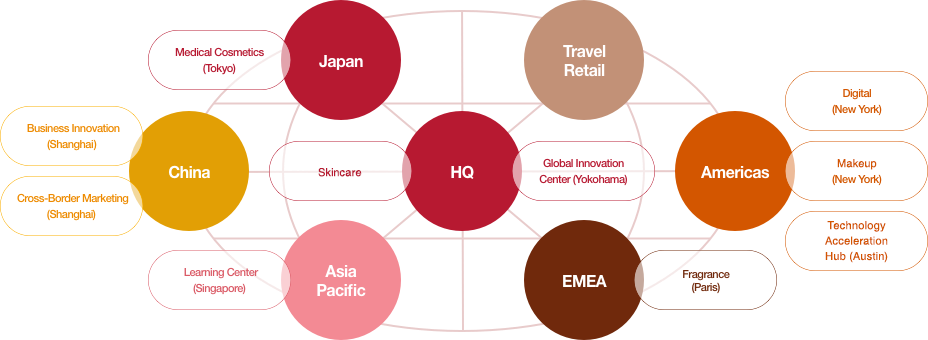

In addition, we have introduced the Centers of Excellence to lead our global value creation. These centers lead our global strategy planning and product development by gathering information and conducting surveys in the most advanced regions of the world for each respective category, such as Japan for skincare, the Americas for makeup and digital, and EMEA for fragrances.

3. Strengthen brand and business portfolio

For each regional headquarters, we examine brand and business portfolios in a timely manner and select priority areas of focus. In 2016, with the aim of strengthening our portfolio for the makeup category in the Americas, we acquired LAURA MERCIER. In the same year, with the intention of strengthening our portfolio for the fragrance category in EMEA, we concluded a license agreement with Dolce&Gabbana.

At the same time, we have withdrawn from unprofitable businesses and transferred brands. With regard to brands and businesses in particular, we are transferring these to companies that provide a larger capacity for growth.

Achievements of the first three years (2015-2017)

In the first three years of VISION 2020, we have implemented various reforms as mentioned above.

As a result, sales in 2017 amounted to 1,005.1 billion yen, and operating profit was 80.4 billion yen, the highest ever. In achieving net sales of 1 trillion yen, the initial target of VISION 2020, three years ahead of schedule, we are ensuring growth.

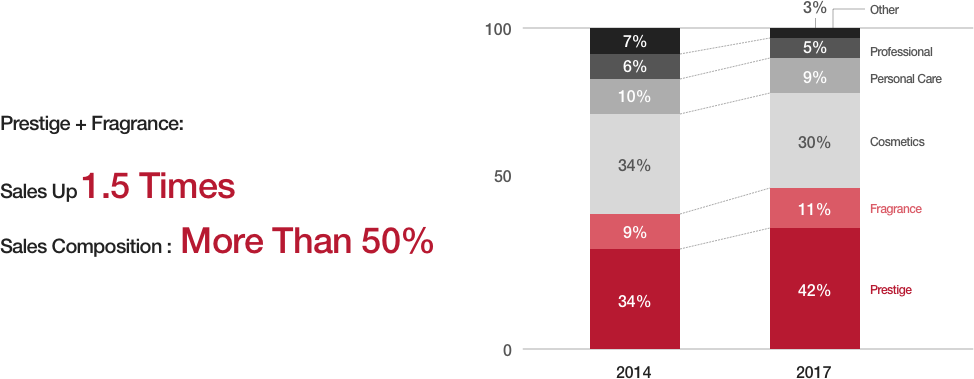

In particular, there has been remarkable growth in prestige brands where we have focused investment, and the combined scale of prestige and fragrance brand sales has expanded by 1.5 times over these three years. In addition, the percentage of such sales has grown to more than 50%.

By region, growth has been driven particularly by Japan, which made a V-shaped recovery, as well as China, where the market is expanding, and Travel Retail, which has strengthened its business through new organization. Cross-border marketing, which sees Japan, China and Travel Retail as one market, contributed to this robust growth.

Issues to be addressed continuously over the next three years

While sales are favorable, demand has been expanding beyond our expectations, and the supply of products has tightened, leading to out-of-stock in core products. In order to continue growing in the future, reinforcing our product supply capability is an urgent issue. In particular, since the demand for made-in-Japan brands is growing rapidly in China and Asian countries, we have decided to strengthen production capacity in Japan by means of short- and medium-to-long-term initiatives aimed at the future, and each of these is moving ahead.

(Please refer to the "Three-Year Plan" page for measures to strengthen product supply capability)

Although the profitability of the overseas business is improving, many problems remain in the Americas and EMEA.

In the Americas business, since the growth of bareMinerals was not realized, we revised and reevaluated the revenue plan accordingly, and recorded an impairment loss in 2017. Looking ahead, we will strive to rebrand to achieve steady growth. In the EMEA business, we will work to increase the growth and profitability of fragrance brands, with Dolce&Gabbana as the lead.

- 1. Build stable supply capability

- 2. Improve the profitability of the Americas and EMEA business

Americas: Turn around bareMinerals

EMEA: Expand sales of Dolce&Gabbana, achieve stable growth of skincare category, optimize organizations

The latter three years of VISION 2020 (2018-2020) Three-Year Plan(announced on March 5, 2018)

The development of new frontiers

For the latter three years from 2018 to 2020, we will work on five key strategies, collectively titled “Building for the Future.”

In addition to strengthening the brand strategy and digitalization in response to consumer needs around the world, we will promote new value creation through the development of new frontiers.

2018-2020 target

We will further strengthen marketing investment to accelerate the growth momentum of the first three years. In particular, we will strengthen investment in prestige and made-in-Japan brands, businesses with strong growth such as Japan and China, and the digital domain.

Accordingly, the basic plan at the time of the Three-Year Plan announcement was over 1,200 billion yen in sales and over 120 billion yen in operating profit in 2020. In addition, we have announced a sales target of more than 1,280 billion yen and operating profit of more than 130 billion yen as a stretch target upon expanding of our supply capability.

In February 2020, based on the results of 2019, we have revised our forecast to sales of 1,220 billion yen, operating profit of 117 billion yen, and an operating profit margin of 9.6% in 2020 (excluding the effect of the novel coronavirus).

2018-20 Five Key Strategies Building for the Future

1. Further Selection and Concentration of Brands and Businesses

Under the Prestige First strategy, we place the highest priority on prestige brands, which are our strength and can be expected to drive our growth and profitability. Accordingly, we will strive to achieve growth by concentrating investment in SHISEIDO, Clé de Peau Beauté, NARS, bareMinerals, IPSA, LAURA MERCIER, and Dolce&Gabbana. In addition, in the Asian region, beginning with China, we will focus on developing made-in-Japan brands such as ELIXIR, ANESSA and SENKA among cosmetics and personal care brands.

We will further enhance our brand equity by strengthening localized marketing that caters to the needs of consumers in each region, and through collaboration with distributors and retailers.

2. Acceleration of Digitalization/

New Business Development

We will strengthen digital marketing and e-commerce worldwide. In e-commerce, we will strengthen cooperation with major e-commerce platforms and advance CRM (Customer Relationship Management) through such efforts as integration with consumer data at stores. We will increase the e-commerce sales ratio worldwide from 8% in 2017 to 15% (40% in China) in 2020.

In addition, as a foundation for business operations, we will promote linkage with business processes among regional headquarters, integration of IT platforms and centralized management of data. In terms of new business development, we will promote personalization in order to realize a value offering that meets the needs of each consumer. In 2019, we established the Technology Acceleration Hub, our center for technological development and collection of latest information. It is located in the United States, the global frontier of the digital domain.

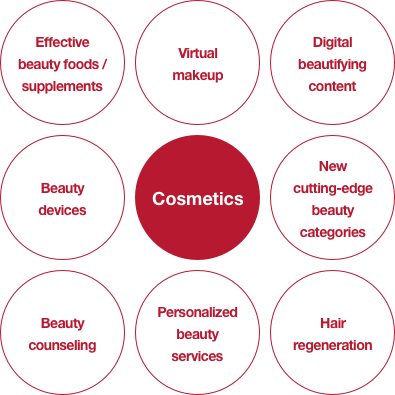

Going forward, we will also create new products and services by compounding existing businesses with digital technologies such as IoT.

3. New Value Creation through Innovation

We will realize further synergies by combining the knowledge we have cultivated, the new brands and technologies that we have acquired through mergers and acquisitions, and human resources who offer high levels of expertise. As a result, we will create new value not only in cosmetics but also in new frontiers such as artificial skin, hair and skin regeneration, and advanced beauty care, and build innovative business models. In addition, we will bolster research and innovation investment, and by 2020 we will realize a research and innovation-to-sales ratio of 3% (4% in the future) and the number of research and innovation personnel will be increased to 1,500.

In April 2019, the Shiseido Global Innovation Center (referred to as "S/PARK"), our Yokohama-based center for global research and innovation, began full operation. We will continue to provide new value for consumers around the world by integrating diverse knowledge, information, and technology aggregated from state-of-the-art research institutes in Japan and overseas as well as from other industries.

Click here for the Global Innovation Center

4. Talent and Organization Development to Be a Global Winner: “PEOPLE FIRST”

In working to achieve VISION 2020 and to create value around the world, our employees are our most important resource. Based on the concept of “PEOPLE FIRST,” Shiseido is increasing its investment in talent development. We are engaged in training programs aimed at developing leaders who will drive Shiseido in the future, promoting diversity, and using English as the company’s official language.

5. New Global Management Structure

Our global management structure launched in 2016 enables us to respond promptly and appropriately to market changes through delegation of responsibility and authority to the CEOs of each regional headquarters.

Since 2018, we have put further efforts into the Centers of Excellence, where the strengths of each region provide the base of value creation, and we have implemented the Connected Multi-Value Creation System. Starting from 2019, we have established the China Business Innovation Center in Shanghai, China, with its remarkable development of new technologies such as digital platforms, and the Technology Acceleration Hub in the United States, where we further advance our technologies such as MatchCo and Giaran. We are sharing knowledge gained at each Center of Excellence with the world and applying it in marketing and product value creation. In addition, by connecting the value creation bases of each Center of Excellence and laboratory, etc., we will implement “Connected Multi-Value Creation” with the aim of creating completely new value going outside of boundaries.

Challenges and Initiatives

In addition to addressing the Five Key Strategies, there are issues to be resolved in order to achieve the 2020 target. The first of these is to strengthen our product supply capability, and the second is to improve the profitability of the Americas and EMEA businesses.

Strengthen production and supply capability

Japan business has had rapid recovery since work began on VISION 2020. In addition, demand for made-in-Japan brands continues to increase in China, other Asian countries, and among inbound tourists to Japan. For that reason, we are strengthening domestic production capacity in the short, medium and long term. In the short term, we are making efforts toward capital investment in three existing plants, increasing personnel, and greatly reducing SKUs. In addition, we are also expanding to outside partner factories and increasing raw material procurement in line with demand.

We are increasing our own production capacity with a focus on the medium-to-long term. The Nasu factory started operation at the end of 2019. The Osaka Ibaraki factory and the Fukuoka Kurume factory are slated to follow suit in 2020 and 2022, respectively. These new locations will introduce IoT and cutting-edge technologies and, when completed, represent a doubling of our domestic production system to six total factories. We will support future growth by transferring and developing “takumi” (craftmanship) skills, the strength of Japanese high-quality manufacturing.

Improve profitability of the Americas and EMEA businesses

In order to improve the profitability of the Americas, we started new marketing towards the revival of bareMinerals, strengthened e-commerce, and also worked on closing down unprofitable stores with the aim of reducing fixed costs. In EMEA, we will increase profitability by expanding sales of Dolce&Gabbana, for which we began production in 2017, and we aim to expand the growth of designer fragrances such as narciso rodriguez.

2020 Plan

Results of 2019 and forecast for 2020

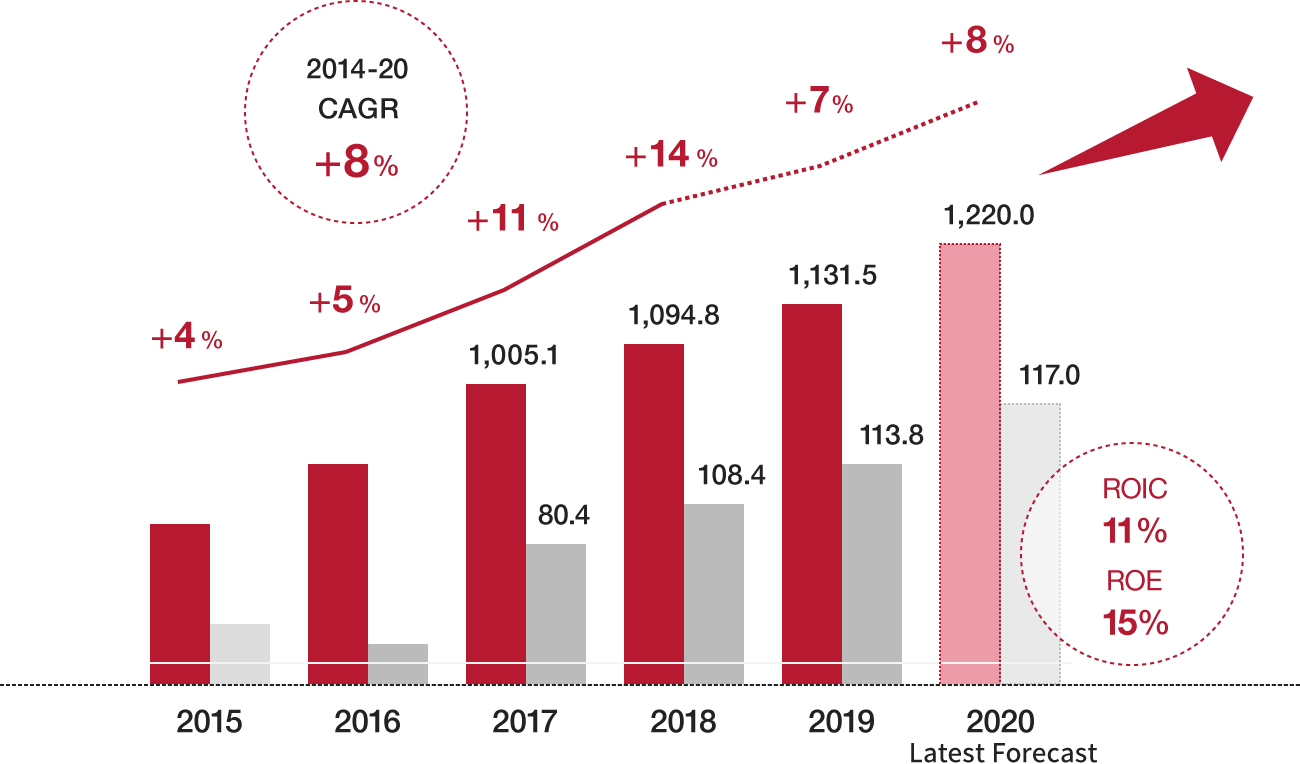

In 2019, in line with the Three-Year Plan, we focused on investment in prestige and made-in-Japan core brands. As a result, we were able to achieve high growth with net sales of 1,131.5 billion yen, which is a 5.7% increase year-on-year on a local currency basis and 6.8% like-for-like growth excluding such factors as business transfers, the application of U.S. GAAP (ASC 606), and the acquisition of the U.S. skincare brand Drunk Elephant in the previous year. Operating profit was 113.8 billion yen, a 5.1% increase from the previous year, with an operating profit margin of 10.1%, mainly driven by an improvement in the product mix stemming from increased sales of prestige brands.

(announced on February 6, 2020)

The forecast for 2020 excluding the effect of the novel coronavirus is net sales of 1,220 billion yen, operating profit of 117 billion yen, and an operating profit margin of 9.6%. We will continue to focus investment on prestige and made-in-Japan cosmetics and personal care brands which are driving growth. In terms of business segments, we will further strengthen investment mainly in China and Travel Retail. At the same time, we will respond more efficiently to the changing needs of consumers in our home market, Japan.

The current forecast does not take into account the effect of the novel coronavirus which has been spreading particularly in Wuhan City, Hubei Province, China, since January 2020 , due to a number of uncertainties it entails. We are currently evaluating the impact on our business. We plan to more carefully assess this impact and reflect it in our business forecasts as appropriate.

2020 Sales Forecast (vs. 2019)

2020 Operating Profit Forecast (vs. 2019)

New Brand: Drunk Elephant

In 2019, we acquired the U.S. prestige skincare brand Drunk Elephant.

The brand has a top-class presence in the U.S. “clean” market* and enjoys strong support from a wide range of consumers. As the clean market is expected to continue growing worldwide, we will leverage our management resources to expand the brand’s presence in Asia and other global markets. With this new addition, we will strengthen our brand portfolio in the highly profitable prestige skincare category in order to increase sales and improve profitability in the Americas. In addition, we will scale up Drunk Elephant's digital marketing expertise and know-how to the entire Shiseido Group.

*A worldwide demand for products that are clean to both the human body and the environment, centering on the younger generations.

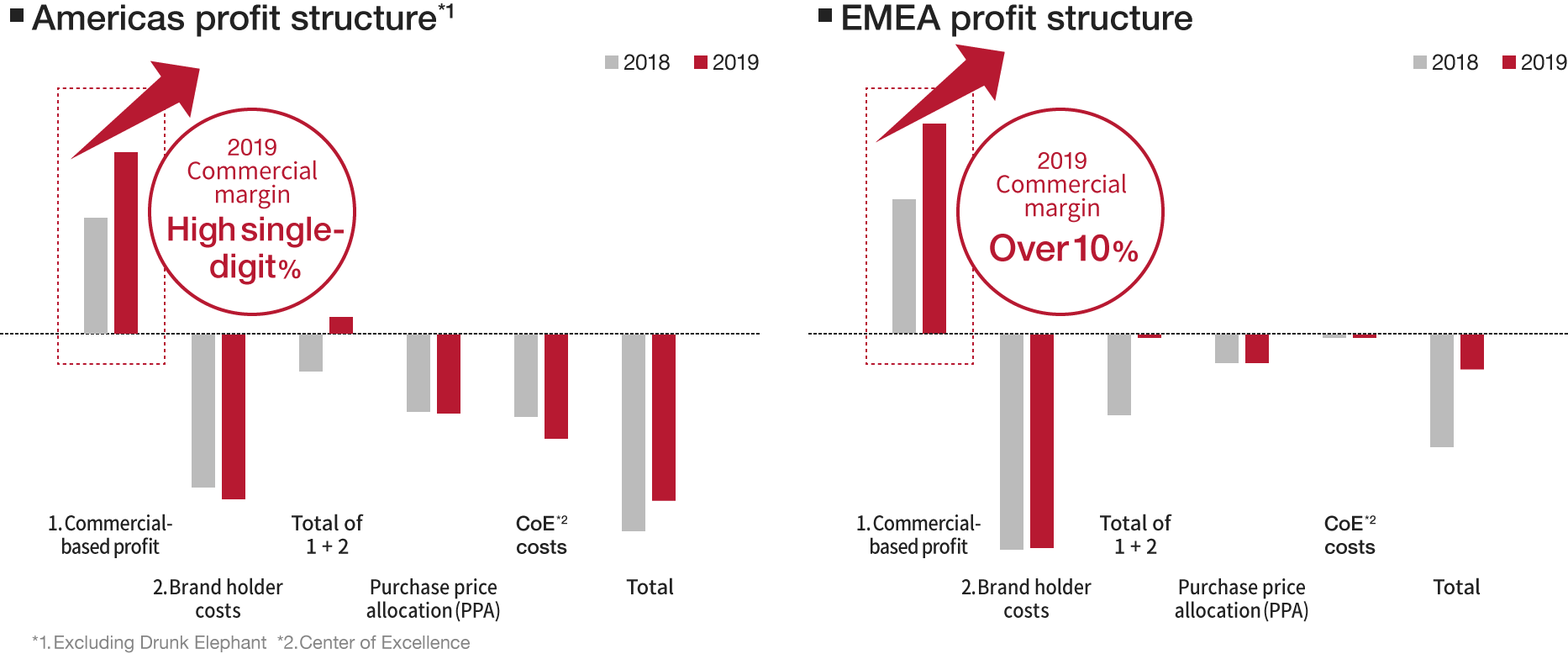

Profit structure in the Americas and EMEA

To improve the profitability of the Americas and EMEA, we have promoted various initiatives such as organizational reforms, integration of offices and systems, and withdrawal from unprofitable businesses. Currently in the Americas, we are also working on closing unprofitable bareMinerals boutiques. The results of these efforts are starting to appear.

Going forward, we will enhance profitability by cultivating and strengthening the brands of each region.

The figure below shows the current profit structure in the Americas and EMEA.

Related to the Americas and EMEA, commercial-based profits are positive (1). Meanwhile, there is a large burden of brand holder costs related to NARS, bareMinerals and LAURA MERCIER in the Americas, and Dolce&Gabbana and other designer fragrance brands in EMEA (2). Profitability in the Americas has grown steadily in 2019, while EMEA almost broke even. In 2020, we will continue our efforts to improve profitability through the growth of our brands.

In addition, the Americas and EMEA are bearing the operating expenses for the Centers of Excellence, which contribute to global value creation. There are three Centers of Excellence in the Americas, which is a factor that reduces statutory-based profit. In the medium to long term, we aim to improve profit by expanding sales growth in each region.

2020 and beyond

VISION 2020 is a medium-to-long-term strategy that sets our targets until 2020 as one point in

time.

However, as a company, we need to continue beyond that point and realize sustainable growth.

Going forward, we will grow to be a global winner and aim for long-term net sales of 2 trillion yen

and operating profit of 300 billion yen.

In addition, we strive to be a company providing a synergistic combination of economic and social values.

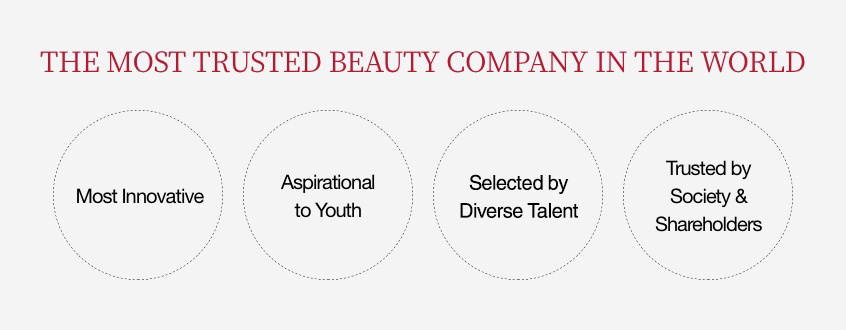

Based on our management policy to “Be the Most Trusted Company in the World,” we aim to be a company that is the most innovative, that is aspired to by youth, that is selected by diverse talent, and that is trusted by society and shareholders.

In 2019, Shiseido formulated a new corporate mission, “BEAUTY INNOVATIONS FOR A BETTER WORLD.” We will bring smiles, joy, happiness and new energy to all people through beauty. Moreover, we will contribute through our business to women’s empowerment, aging, and appearance care for those with deep concern for their skin, among other efforts. In addition, we will strengthen our response to environmental issues, including initiatives to deal with climate change, UV radiation, and marine pollution.

OUR MISSION

To become a company that remains vital for the next 100 years,

we will continue various initiatives to “Be a Global Winner with Our Heritage.”

Reappointment of President and CEO

We announced a news release “Reappointment of President and CEO” on September 26, 2019.

For details, please check the news release and video.

-

Message from

Message from

External Director Yoko Ishikura

External Director and Chair of

Nomination Advisory Committee of the Company 4min video Watch Video

ABOUT US

- Regional Headquarters

BRANDS

- Prestige

- Inner Beauty

- Life Quality Beauty

- Quality Assurance

SUSTAINABILITY

- Materiality Core Activities

- Culture・Governance

- Data

INNOVATION

- Related Links

- Our Products Policy

- BEAUTY TECHNOLOGY LAB by Shiseido

CAREERS

INVESTORS

- IR Library