- Home

- INVESTORS

- Corporate Governance

- Audit Structure

Audit Structure

Status of Internal Audit

1. Internal Audit Objectives and Policies

The control environment is premised on our corporate philosophy (THE SHISEIDO PHILOSOPHY). On this basis, the Group's internal audits aim to contribute to sustainable growth and the enhancement of corporate value through the promotion of appropriate control and improvement activities. Conducted in accordance with “The Internal Audit Rules” established by the Internal Audit Department, these audits comprehensively examine the state of our Group's internal controls from the perspectives of operational effectiveness and efficiency, reliability of financial reporting, compliance with relevant laws and internal regulations, and asset preservation. Additionally, the department assesses the validity and effectiveness of risk management and provides advice and recommendations for improvements.

In order to achieve the above objectives, Representative Corporate Executive Officer, Chairman and CEO will provide the necessary resources to enable the department to conduct high-quality internal audits, and through the use of the internal audit function, we will further evolve into an organization with high ethics and integrity, aiming to become a company trusted by all stakeholders.

2. Organization and Personnel Structure

During fiscal year 2023, the Internal Audit Department reported directly to Representative Director, Chairman and CEO and ensured multiple reporting lines, including monthly reports to Representative Director, Chairman and CEO, CFO, and Audit & Supervisory Board members, and periodically to the Board of Directors and the Audit & Supervisory Board.

With regard to internal control over financial reporting, in accordance with the internal control reporting system based on the Financial Instruments and Exchange Law, the Internal Audit Department, as an independent division, compiled and reviewed the group-wide assessment of internal control and then conducts a final assessment. The status of audit implementation and evaluation results were reported in the same manner as above.

After the General Meeting of Shareholders in March 2024, the organization will be under the direct control of the Audit Committee to ensure greater independence and objectivity and will report periodically to the Audit Committee on the status of the audit and its results, as well as monthly to the Representative Corporate Executive Officer, Chairman and CEO, CFO, and periodically to the Board of Directors, etc., to ensure multiple reporting lines. In the event of conflicting instructions or decisions between the Representative Corporate Executive Officer and the Audit Committee, the opinion of the Audit Committee shall prevail.

As of December 31, 2023, we have 19 members of the Internal Audit Department at the Head Office and six members of the Internal Audit Department at offices belonging to the Head Office in Europe, the Americas, Asia, and China (mainly locally hired). Approximately half of our employees hold professional certifications such as Certified Internal Auditor (CIA), Certified Information Systems Auditor (CISA), Certified Fraud Examiner (CFE), or Certified Public Accountant in Japan and the U.S., and we encourage those who do not hold these certifications to obtain them as we aim to build trust as a highly professional organization. In addition to having seasoned staff with an average of five to six years of experience in internal auditing, we utilize a skills matrix within the Internal Audit Department, and where the department lacks expertise, we bring in staff from other departments with that expertise to maintain a well-balanced composition of personnel. When resources are insufficient in terms of in-house expertise and number of staff, outside experts are utilized as needed.

In addition to the above, we have 18 full-time auditing staff with reporting lines to local management at major subsidiaries in Japan and overseas, depending on the risk base, to form a system capable of responding quickly to local situations.

To improve the quality of our internal audits, several CIAs experienced in conducting external quality evaluations will conduct internal audit quality evaluations based on the International Standards for the Professional Practice of Internal Auditing (Standards) of the Institute of Internal Auditors (IIA), and we are continuously improving our departmental management and operations to prepare for periodic external evaluations in the future. As we unify core systems at the global level, we are taking this chance to enhance data analysis capabilities in the Internal Audit Department to improve quality.

Audit Committee‘s Audits and Initiatives toward Strengthening Its Functions

During fiscal year 2023, the Company went from having an Audit & Supervisory Board and transitioned to a company with three statutory committees as of March 26, 2024. The Audit Committee consists of five members—three Independent External Directors and two non-executive Internal Directors—who lead organizational audits by setting audit policies and providing information to the Internal Audit Department, thus promoting effective auditing practices. The committee is chaired by an Independent External Director who is a lawyer with extensive knowledge of laws, regulations, and corporate governance.

The Audit Committee shall provide instructions to the department in charge of internal audit. In addition, regular meetings shall be held to exchange opinions between the Representative Corporate Executive Officers and Audit Committee members. The Company shall establish a system to ensure that audits are effectively conducted by the Audit Committee through measures such as holding liaison meetings between the Audit Committee, the department in charge of internal audit, and accounting auditors and ensuring that Audit Committee members or members of the department in charge of internal audit attend the relevant meetings, on request from the Audit Committee.

Accounting Audits

The Company's accounting audit is conducted by KPMG AZSA LLC, an accounting auditor pursuant to the Companies Act and the Financial Instruments and Exchange Act.

The names of certified public accountants that have conducted auditing and the name of auditing firm are as follows:

Matters Concerning Accounting Auditor (As of December 31, 2023)

- 1.Name of Accounting Auditor

KPMG AZSA LLC - 2.Period of the consecutive audit by the Accounting Auditor

The Company selected KPMG AZSA LLC as its accounting auditor on June 29, 2006.

Thus, the period of the consecutive audit by the accounting auditor is 18 years of this fiscal year. - 3.Names of certified public accountants engaged in audit work

Masakazu Hattori (consecutive auditing period: four years)

Kentaro Hayashi (consecutive auditing period: four years)

Unshil Kang (consecutive auditing period: three year)

Note:The rotation of engagement partners is carried out appropriately in accordance with the policies established by KPMG AZSA LLC.

The rotation of engagement partners at KPMG AZSA LLC is regulated by laws, regulations on independence, and the audit firm’s policies (including policies of KPMG International Limited) regarding the maximum period of time for involvement in audit and attestation services. KPMG AZSA LLC monitors rotation status from the perspective of continuous involvement and independence, including assistant auditors. - 4.Composition of assistant auditors

The composition of personnel other than engagement partners is 21 certified public accountants, 8 qualified professionals, and 34 others (tax-related and IT audit staff, etc.) - 5.Selection policy, reason of the selection and evaluation of the Accounting Auditor

The selection and dismissal of the Company’s accounting auditor is determined by the unanimous consent of Audit Committee after discussions based on the results of evaluations by the Audit Committee, as well as evaluations by the Corporate Executive Officer and CFO, and heads of related departments including Financial Accounting Department and Internal Audit Department.

The Company’s policy for decision-making on dismissal or non-reappointment of the accounting auditor is as follows.

In the event that the Company determines that keeping the accounting auditor causes material trouble to the Company for the reasons, among others, that the accounting auditor has violated its duties, negated its duties, or behaved in a manner inappropriate of an accounting auditor, the Audit Committee shall dismiss the accounting auditor pursuant to Article 340 of the Companies Act. Furthermore, suppose it is deemed that the accounting auditor is unable to carry out its duties duly or change of the accounting auditor to another audit firm is reasonably required to enhance the appropriateness of the accounting audit. In that case, the Board of Directors shall submit a proposal to the general meeting of shareholders for the dismissal or non-reappointment of the accounting auditor in accordance with the resolution of the Audit Committee on the proposal resolved in consideration of the opinion of the executive bodies.

The Audit & Supervisory Board evaluated the accounting audits of the accounting auditor for Fiscal 2023 and confirmed the appropriateness of the auditor, quality control, independence and professional competence of the audit team, appropriateness of the audit plan, communication with the Audit & Supervisory Board and other relevant parties, status of the accounting auditor’s remuneration, and processes, and resolved to reappoint the accounting auditor for the fiscal year 2024.

Mutual Cooperation among Internal Audits, Audit Committee’s Audits and Accounting Audits

The Company, in order to improve the effectiveness and efficiency of the so-called three-pillar audit system (internal audits, audit committee’s audits, and accounting audits), has been making efforts to enhance the mutual cooperation among the parties concerned by such means as arranging regular liaison meetings to report on audit plans and audit results as well as to conduct exchanges of opinions.

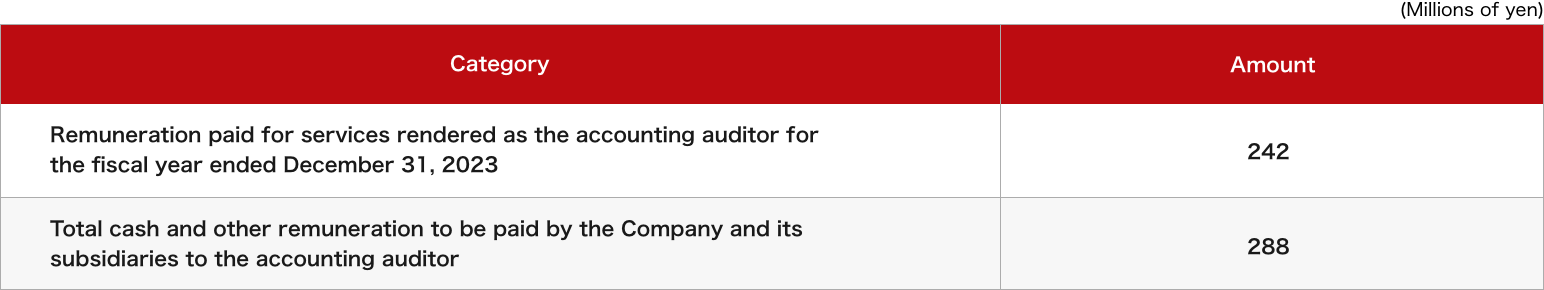

Remuneration, etc. to the Accounting Auditor

Note: In the audit contract between the Company and its accounting auditor, remuneration paid for audits under the Companies Act and remuneration paid for audits under the Financial Instruments and Exchange Act are not clearly distinguished and cannot be practically separated. Therefore, the total payment for both is shown in “Remuneration paid for services rendered as the accounting auditor for the fiscal year ended December 31, 2023” above.

Reason for Audit and Supervisory Board to Have Agreed to Remuneration, etc. to the Accounting Auditor

The Audit and Supervisory Board of the Company reviewed the status of performance of duties and basis for the calculation of the estimated amount of remuneration in the previous fiscal year as well as the validity of both descriptions in the audit plan prepared by the accounting auditor during the fiscal year and the estimated amount of remuneration, using the “Practical Guidelines for Cooperation with accounting auditors” released by the Japan Corporate Auditors Association as a guide, and by way of necessary documents obtained from directors, internal relevant departments and the accounting auditor as well as interviews to obtain information from them, and determined that the fees, etc. of the accounting auditor were appropriate, in agreement with Article 399, Paragraphs 1 and 2 of the Companies Act.

Details of Services Other Than Audit

Not applicable.

Policy Relating to Determination of Dismissal of or Not to Reappoint Accounting Auditor

In the event that the Company determines that keeping an accounting auditor as its accounting auditor causes material trouble to the Company for the reasons, among others, that the accounting auditor has violated its duties, negated its duties or behaved in a manner inappropriate as an accounting auditor, the Audit Committee shall dismiss the accounting auditor pursuant to Article 340 of the Companies Act.

Furthermore, in the event that it is deemed that the accounting auditor is unable to carry out its duties duly or change of the accounting auditor to another audit firm is reasonably required to enhance the appropriateness of accounting audit, the Board of Directors shall submit a proposal to the general meeting of shareholders for the dismissal of the accounting auditor or not to reappoint the accounting auditor in accordance with the resolution of the Audit Committee on the proposal resolved in consideration of the opinion of the executive agency

ABOUT US

- Regional Headquarters

BRANDS

- Prestige

- Inner Beauty

- Life Quality Beauty

- Quality Assurance

SUSTAINABILITY

- Materiality Core Activities

- Culture・Governance

- Data

INNOVATION

- Related Links

- Our Products Policy

- BEAUTY TECHNOLOGY LAB by Shiseido

CAREERS

INVESTORS

- IR Library