- Home

- INVESTORS

- Corporate Governance

- Remuneration for Directors and Corporate Executive Officers

Remuneration for Directors and Corporate Executive Officers

1. Basic Philosophy of the Remuneration to Directors and Executive Officers of the Company

The Company regards the remuneration policy for Directors and Corporate Executive Officers as an important matter for corporate governance. For this reason, in accordance with the following basic philosophy, the Directors and Corporate Executive Officers remuneration policy of the Company is deliberated and decided in the Compensation Committee chaired by an External Director to incorporate objective points of view.

Basic philosophy and policy of the remuneration to Directors and Corporate Executive Officers

The remuneration policy to Directors and Corporate Executive Officers shall:

- 1.encourage to realize the corporate mission;

- 2.aim to ensure attractive remuneration to acquire and retain top talent in global talent market;

- 3.aim to enhance the long-term corporate value and strongly incentivize to achieve the company’s long-term vision and medium- to long-term strategy;

- 4.have a mechanism incorporated to prevent overemphasis on short-term views while instilling motivation to achieve short-term goals;

- 5.be designed as transparent, fair and reasonable from the viewpoint of accountability to stakeholders including shareholders and employees, and remuneration shall be determined through appropriate processes to ensure those points.

- 6.be designed to establish remuneration standards based on the significance (Grade) of role/responsibility reflecting the mission of respective Directors and Executive Officers, and differentiate remuneration according to the level of strategic target accomplished (achievements).

2. The Company’s Directors and Corporate Executive Officers Remuneration Policy

Based on the above basic philosophy, the Compensation Committee has resolved its policy on decisions regarding remuneration of individual Directors and Corporate Executive Officers.

The Company’s Directors and Corporate Executive Officers remuneration policy, including an outline of the contents of the policy on decisions regarding remuneration of individual Directors and Corporate Executive Officers, is described below in detail.

◼ Overall picture

The remuneration of Corporate Executive Officers (including those who concurrently assume the position of Directors) comprises “basic remuneration” as fixed remuneration as well as “annual incentive” and “long-term incentive-type remuneration (non-monetary remuneration)” as performance-linked remuneration, and the Company sets remuneration levels by benchmarking peer companies in the same business industry or in the similar business size inside or outside Japan and by taking the Company’s financial condition into consideration. The remuneration of individual Directors and Corporate Executive Officers are determined after deliberations by the Compensation Committee.

In addition, External Directors who are independent from business execution and Directors who are the members of the Audit Committee receive only basic remuneration, as variable remuneration such as performance-linked remuneration is not appropriate.

〔The proportion of each remuneration element for Corporate Executive Officers〕

Notes :

- 1. The proportions shown in the above table may change depending on the Company’s performance and/or its stock price’s fluctuation, as financial value of performance-linked remuneration is shown at target where the Company pays 100%.

- 2. There is no differentiated proportion of each remuneration element for Corporate Executive Officers pegged to having a representation right.

- 3. Because different remuneration tables will be applied depending on the Grade of Corporate Executive Officers, proportions of each individual remuneration element will vary even within a same title.

◼ Basic remuneration

The Company designs basic remuneration in accordance with Grades based on the size and level of responsibility of Corporate Executive Officers in charge, as well as the impact on business management of the Group. In addition, even at the same Grade, the basic remuneration may increase within a certain range based on the individual Corporate Executive Officer’s performance for the previous fiscal year (numerical business performance and personal performance evaluation). This ensures the Company to reward Corporate Executive Officers for their individual outstanding achievement.

Basic remuneration for each Corporate Executive Officer is determined by the Compensation Committee, and is paid in equal installments every month.

◼ Performance-linked remuneration

The performance-linked remuneration consists of an “annual incentive” provided as an incentive for achieving goals for the corresponding fiscal year, and “performance-linked stock compensation (performance share units) as long-term incentive-type remuneration”provided with the aims of establishing a sense of common interests with the shareholders and instilling motivation to enhance corporate value over the medium to long term. Accordingly, it is designed to motivate Corporate Executive Officers to manage business operations while being more conscious about the Company’s performance and share price from the perspectives of not only a single year but also over the medium to long term.

■ Annual incentive

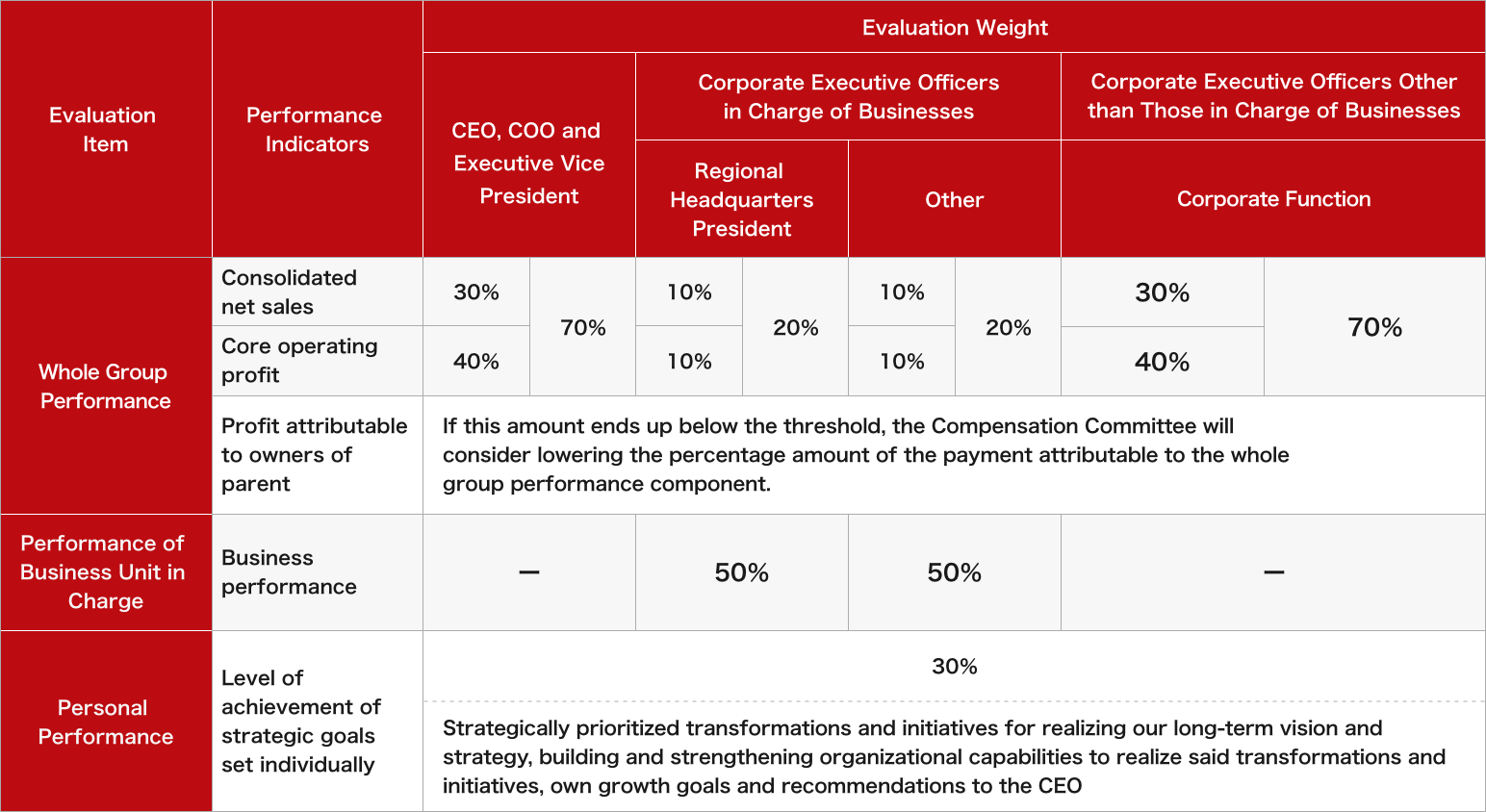

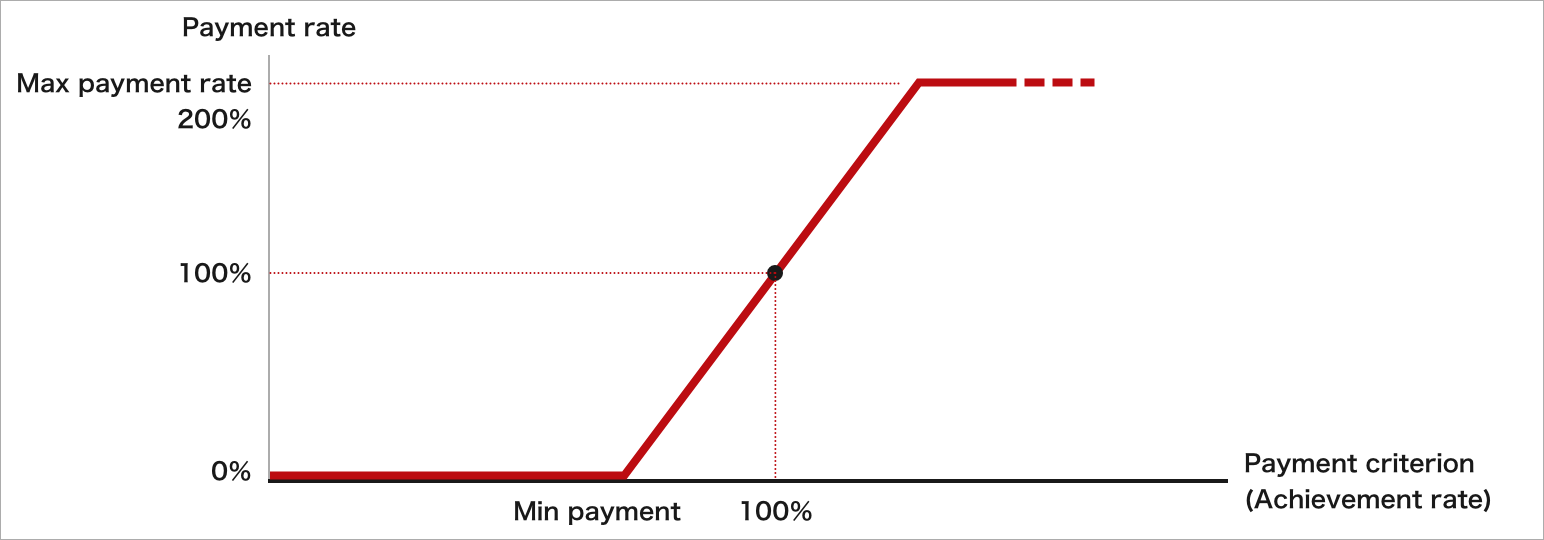

Of the performance-linked remuneration the Company has set performance indicators for the annual incentive in accordance with the scope that Corporate Executive Officers are in charge of as described in the table below, in addition to the achievement rate of target consolidated net sales and core operating profit which are financial indicators, as common performance indicators across Corporate Executive Officers, and the range of changes in the percentage amount of payment is set between 0% and 200%. Although it is essential that the entire management team remain aware of matters involving profit attributable to owners of parent, it is crucial that management not let the benchmark weigh too heavily on proactive efforts particularly involving future growth-oriented investment and resolving challenges with our sights set on achieving long-term growth. As such, upon the Compensation Committee deliberation, the Company has preliminarily established certain performance standards (thresholds) as described in the table below, with the evaluation framework designed so that the Compensation Committee will consider the possibility of lowering the percentage amount of the annual incentive payment attributable to the whole group performance component of the total annual incentive, if results fall below the thresholds. In determining the achievement rate of each target and threshold for consolidated net sales, core operating profit and profit attributable to owners of parent, actual performance may be adjusted by resolution of the Compensation Committee. In cases where such adjustments are made, it shall be stated in the disclosure materials of the actual remuneration of Corporate Executive Officers.

In addition, we set the personal performance evaluation of Corporate Executive Officers in order to add the level of achievement regarding strategic goals that cannot be measured by the financial performance figures alone, such as efforts for restructuring of the business platform and transformations to realize sustainable growth, to evaluation criteria.

Annual incentive is paid once a year.

〔Performance indicators and evaluation weights for annual incentive for Corporate Executive Officers〕

Notes :

There is no difference in the performance indicators and the weight of performance indicators applied to Corporate Executive Officers based on whether a Corporate Executive Officers has a representation right or otherwise.

〔Model of annual incentive payment rate〕

■ Long-term incentive-type remuneration

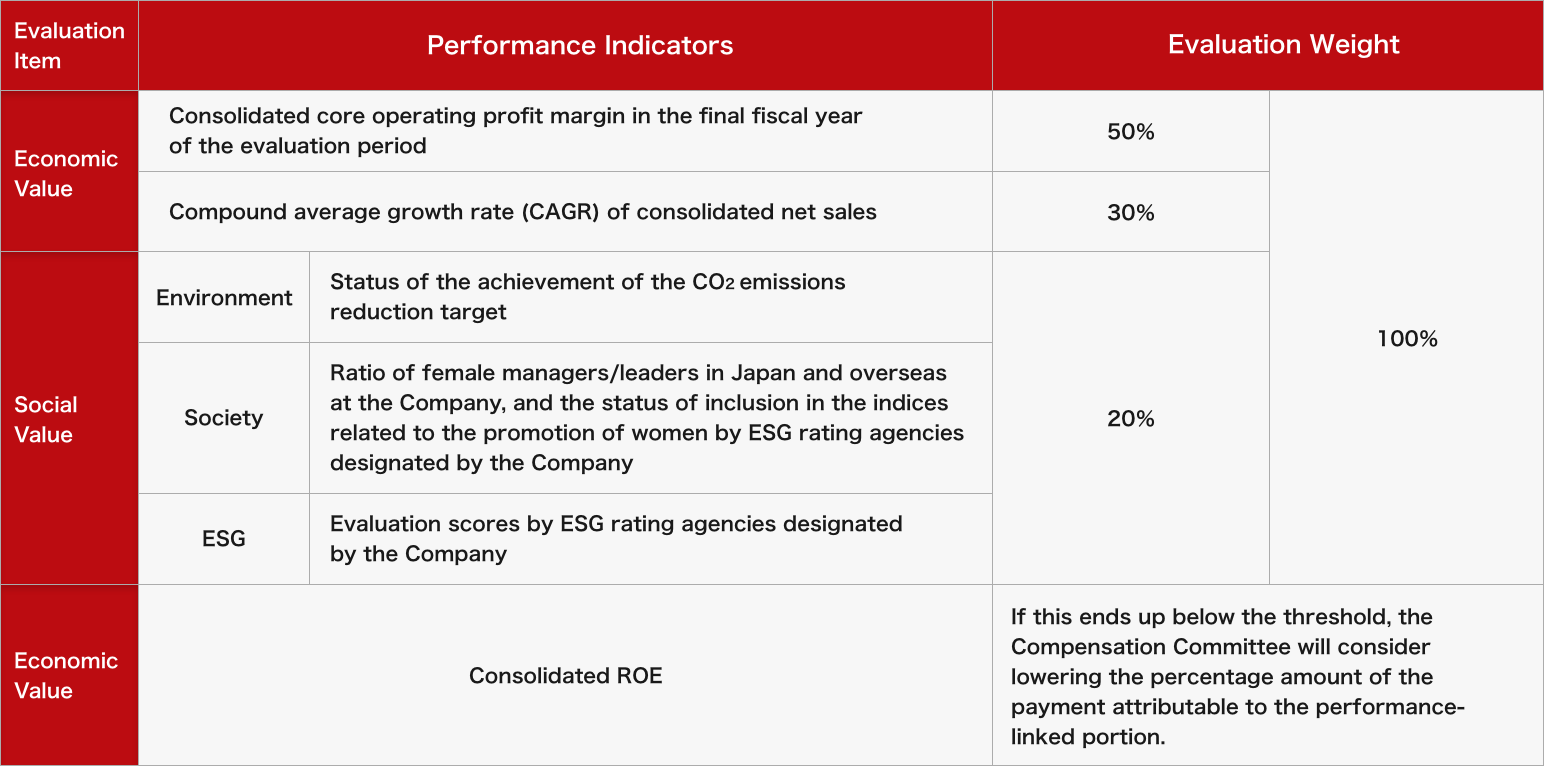

From fiscal year 2019, the Company has introduced performance share units, a type of performance-linked stock compensation, and has incentivized the creation of corporate value over the medium to long term through annual payments. As performance indicators to evaluate the enhancement of economic value, a mix of quantitative targets to be aimed for with a long-term perspective has been set under the medium- to long-term strategy. In addition, as benchmarks on creation of social value, the Company has set multiple internal and external indicators pertaining to the environment, society and governance (ESG). Accordingly, the remuneration is designed for the purpose of creating corporate value from both aspects of economic and social values, as well as establishing a sense of common interests with shareholders.

〔Purposes of introducing the LTI〕

The LTI is adopted for the purposes of establishing effective incentives for creating and maintaining corporate value over the long term, and ensuring that the Directors’ interests consistently align with those of our shareholders. To such ends, the LTI will help:

- i) promote efforts to create value by achieving our long-term vision and strategic goals,

- ii) curb potential damage to the corporate value and maintain substantial corporate value over the long term,

- iii) attract and retain talent capable of taking on leadership in business, and

- iv) realize a “Global One Team” by fostering a sense of solidarity among management teams of the entire Shiseido Group and instilling the consciousness of participating in the running of the Company.

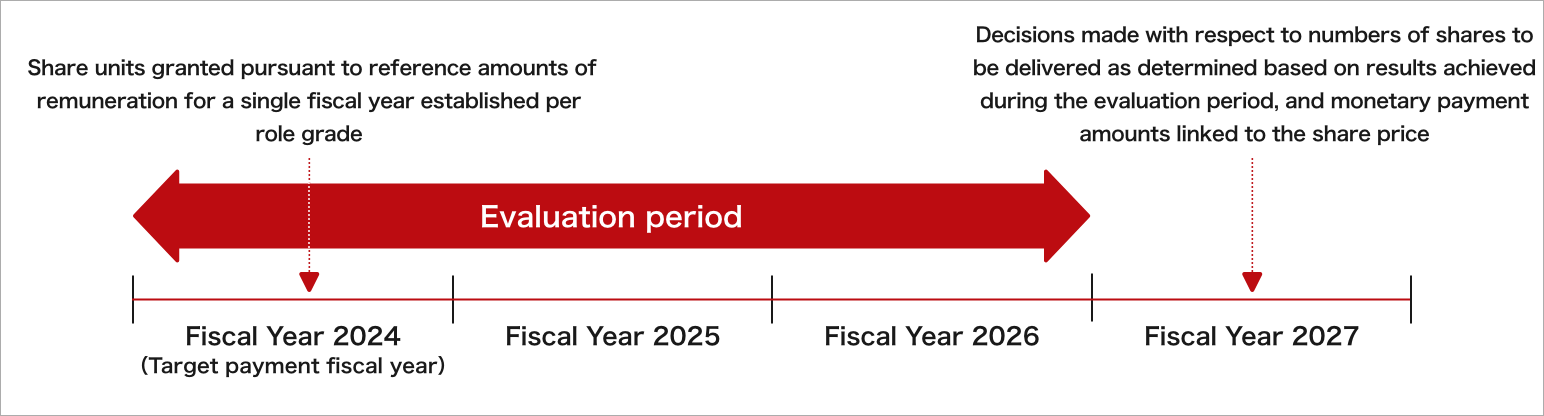

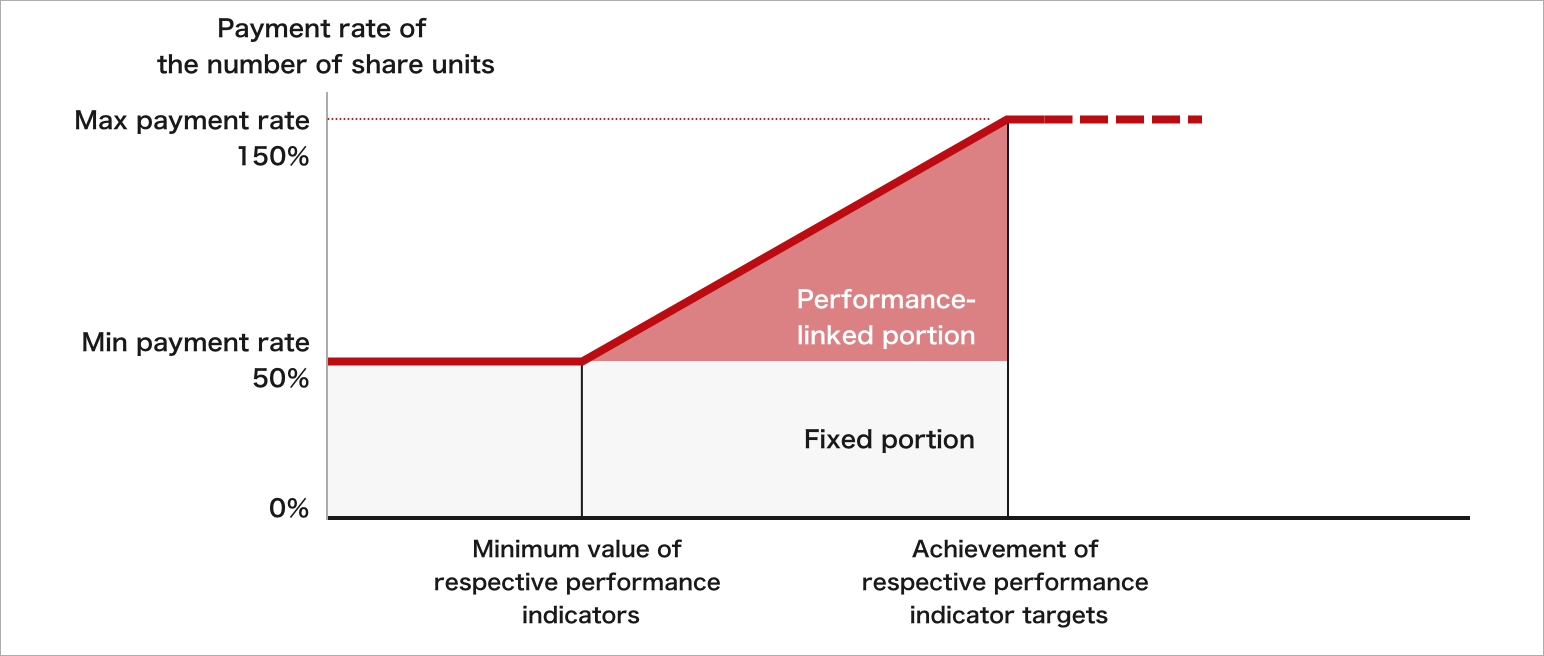

Under the Company’s performance share units, the Company will allot a reference share unit to each of the eligible parties once every fiscal year, and on each annual allotment, the number of fiscal years that the payment relates to shall be one fiscal year. To make such allotments, the Company shall establish multiple performance indicators whose evaluation period is for three years including the fiscal year related to the payment. The Company shall use the respective achievement ratios of each performance indicator to calculate the payment rate in a range from 50% to 150% after the end of the evaluation period, and it shall use the payment rate to increase or decrease the number of share units. The eligible parties shall be paid monetary remuneration claims for the delivery of the shares of the Company’s common stock and cash corresponding to the applicable number of share units, and then each eligible party shall receive delivery of shares of common stock of the Company by paying all the monetary remuneration claims using the method of contribution in kind. Meanwhile, it features a fixed portion involving a set payment in addition to its performance-linked portion. As such, the LTI is designed to help eligible parties realize the aims of more robustly ensuring that their sense of interests consistently aligns with those of our shareholders, curbing potential damage to corporate value and maintaining substantial corporate value over the long term, and helping to attract and retain competent talent.

Regarding evaluation indicators for the long-term incentive-type remuneration in fiscal year 2024, as an indicator for economic value of corporate value, the Company has set the compound average growth rate (CAGR) of consolidated net sales from fiscal year 2023 to fiscal year 2026 and the consolidated core operating profit margin for fiscal year 2026. Furthermore, the Company has adopted the multiple internal and external indicators pertaining to the environment, society and corporate governance (ESG) as benchmarks on creation of social value to ensure the structure to support the increase of the corporate value in terms of both economic value and social value. The Company also has added consolidated ROE which is an important indicator in measuring corporate value to the evaluation indicators in order to share a sense of profit with shareholders.

The requirement for the payment of the long-term incentive-type remuneration is that the eligible parties have been in the position of either Director or Corporate Executive Officer during the predetermined period.

The Company has introduced the malus and clawback provisions for performance share units. Specifically, in certain conditions, such as in case of serious misconduct of the eligible parties, the Compensation Committee is entitled to make the decision to reduce the number of the share units or receive a refund.

The long-term incentive-type remuneration is also paid to principal executive persons in and outside Japan to realize a “Global One Team” by fostering a sense of solidarity among global management teams and instilling the consciousness of participating in the running of the Company.

〔LTI schedule〕

〔Performance indicators and evaluation weights for performance-linked portion of the LTI〕

- *The evaluation in 2024 is based on the MSCI ESG Rating.

〔Model for payment rate of the number of share units for the LTI〕

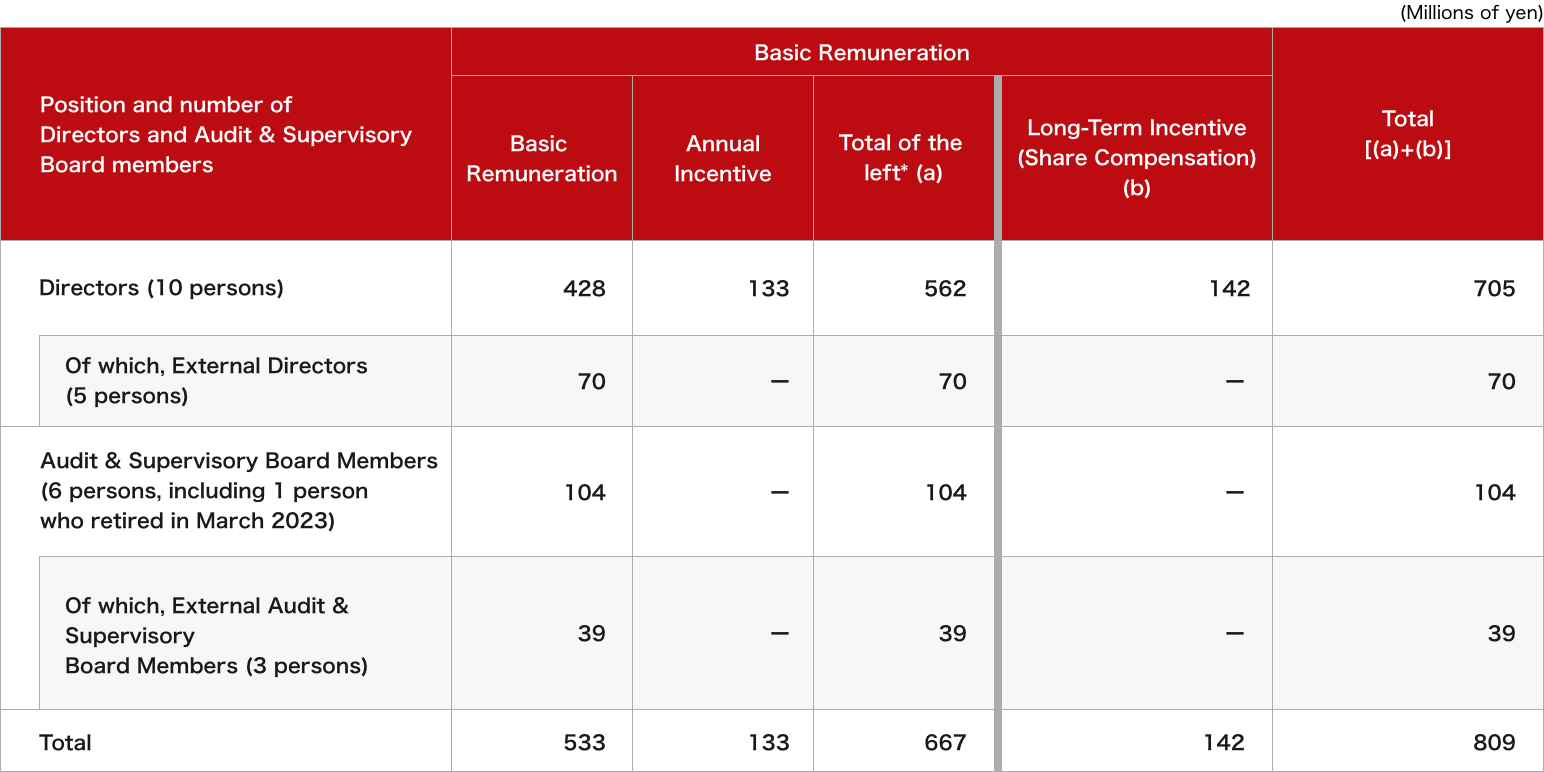

■ Amount of Remuneration, etc. to Directors and Audit & Supervisory Board Members for the Fiscal Year Ended December 31, 2023

- *Total remuneration in cash that has been confirmed by March 2024.

Notes:

- 1. The total amount of the basic remuneration and annual incentive for Directors has a ceiling of ¥2.0 billion annually (including a total of ¥0.2 billion or less for External Directors) as per the resolution of the 118th ordinary general meeting of shareholders held on March 27, 2018. The number of Directors at the conclusion of the said general meeting of shareholders was six (three of whom were External Directors). Furthermore, it was resolved at the 123rd ordinary general meeting of shareholders (March 24,2023) that, separate from the monetary remuneration, up to 136,000 shares would be provided as performance-linked stock compensation (performance share units) (of which, with a maximum of 68,000 shares, the portion equivalent to 50% of the remuneration, etc. based on the aforesaid remuneration policy is provided in monetary remuneration claims for the delivery of shares of the common stock of the Company and the rest in cash) to Directors excluding External Directors. The number of Directors at the conclusion of the said general meeting of shareholders was ten (five of whom were External Directors). Basic remuneration for Audit & Supervisory Board members has a ceiling of \10 million per month as per the resolution of the 105th ordinary general meeting of shareholders held on June 29, 2005. The number of Audit & Supervisory Board members at the conclusion of the said general meeting of shareholders was five.

- 2. The annual incentive of Directors for fiscal year 2023 indicated above represent the amounts that were determined by the Board of Directors based on the resolution of the 118th ordinary general meeting of shareholders, as stated in note 1. Regarding the calculation of those amounts, please refer to the following Performance-linked targets, actual performance and payment percentage, etc. of annual incentives paid to Directors excluding External Directors.

- 3. The amount of long-term incentive-type remuneration (stock compensation) indicated above represents the total amount of the expenses recognized and measured in accordance with IFRS 2 “Share-based Payment” for the fiscal year ended December 31, 2023, on the performance-linked stock compensation (performance share units), upon the approval of the ordinary general meeting of shareholders, in consideration of duties executed by Directors. It has been resolved that the portion equivalent to 50% of the remuneration, etc. based on the aforesaid remuneration policy is provided in monetary remuneration claims for the delivery of shares of the common stock of the Company and the rest in cash. The said amount of the expenses recognized includes -\22 million in adjustment to the expenses recognized based on the achievement rate of performance indicator of the delivered long-term incentive-type remuneration (stock compensation).

- 4. In addition, an adjustment of -\1 million was recorded to the expenses recognized for the fiscal year ended December 31, 2022, on the performance-linked stock compensation (performance share units) delivered to one Director of the Company, at the time the Director served as an executive officer or an employee not holding the office of a Director.

- 5. None of the Directors or the Audit & Supervisory Board members was paid remuneration other than described above (including that described in notes 1. through 4.).

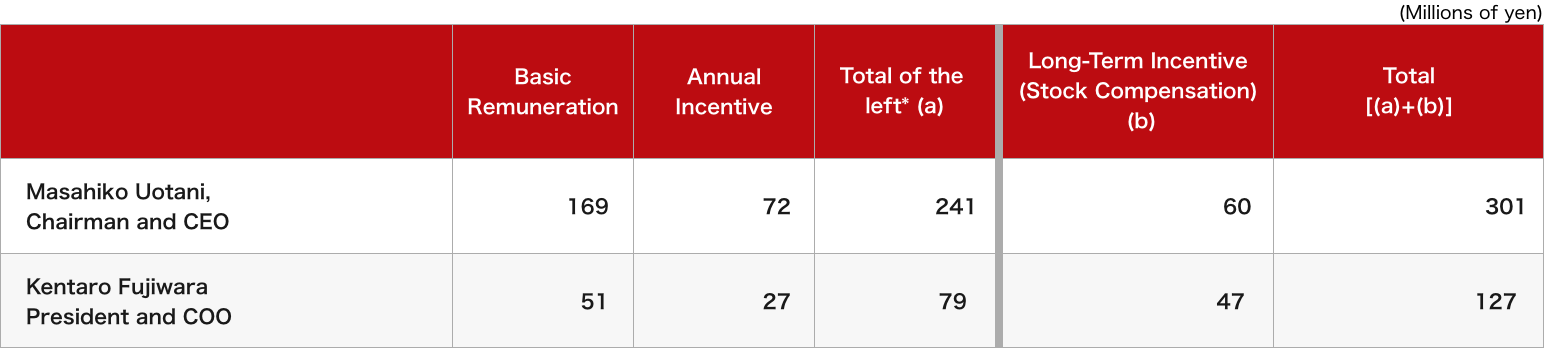

■ Amounts of Remuneration, etc. to Representative Directors and Directors Whose Total Amount of Remuneration, etc. Exceeded \100 Million for the Fiscal Year Ended December 31, 2023

- *Total remuneration in cash that has been confirmed by March 2024.

Notes:

- 1. The annual incentive of Directors for fiscal year 2023 indicated above represent the amounts that were determined by the Board of Directors based on the resolution of the 118th ordinary general meeting of shareholders, as stated in note 1. of Amount of Remuneration, etc. to Directors and Audit & Supervisory Board Members for the Fiscal Year Ended December 31, 2023.

- 2. The amount of long-term incentive-type remuneration (stock compensation) indicated above represents the total amount of the expenses recognized for the fiscal year ended December 31, 2023, recognized and measured in accordance with IFRS 2 “Share-based Payment” on the performance-linked stock compensation (performance share units), upon the approval of the ordinary general meeting of shareholders, in consideration of duties executed by Directors. The said amount of the expenses recognized includes an adjustment of -\21 million to the expenses recognized based on the achievement rate of performance indicator of the delivered long-term incentive-type remuneration (stock compensation).

- 3. No director above was paid remuneration other than described above (including that described in notes 1. through 2.).

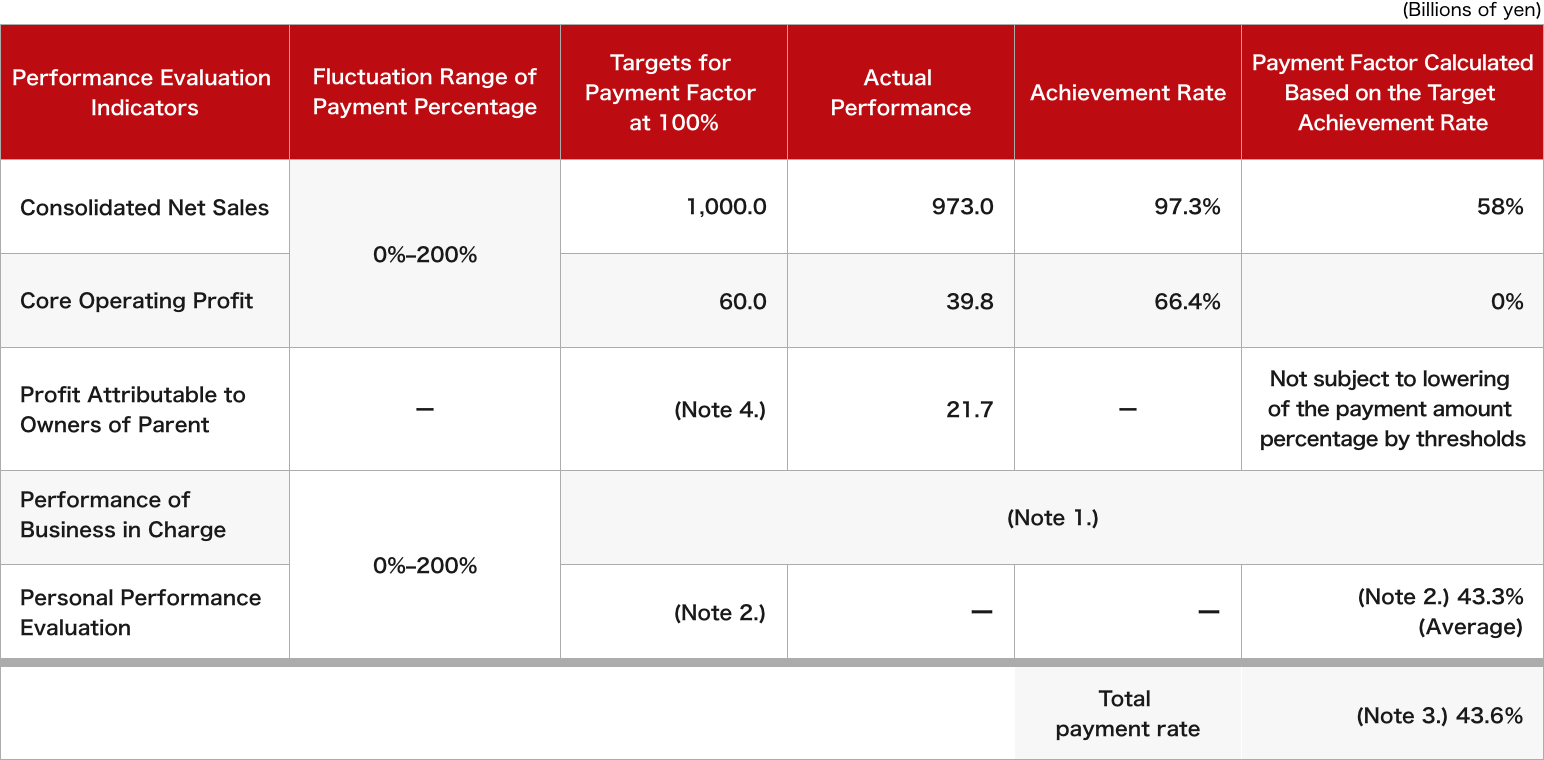

■ Performance-linked targets, actual performance and payment percentage, etc. of annual incentive paid to Directors excluding External Directors

Notes :

- 1. Performance evaluation indicators such as net sales, profits and cost indices, etc. are set to measure performance of respective business. Specific figures are not disclosed.

- 2. Each individual’s priority targets are set in personal performance evaluation considering not only a single fiscal year performance but also initiatives to realize long-term strategies that reflect management approach and Corporate Philosophy, such as improvement in organizational skills.

- 3. The total payment rate is the ratio of the actual amount paid to the target amount of annual incentive for Directors.

- 4. Net profit attributable to owners of parent is set as a benchmark for the Nomination & Remuneration Advisory Committee to discuss the notion of lowering the payment percentage in the event that profit attributable to owners of parent falls below certain thresholds set.

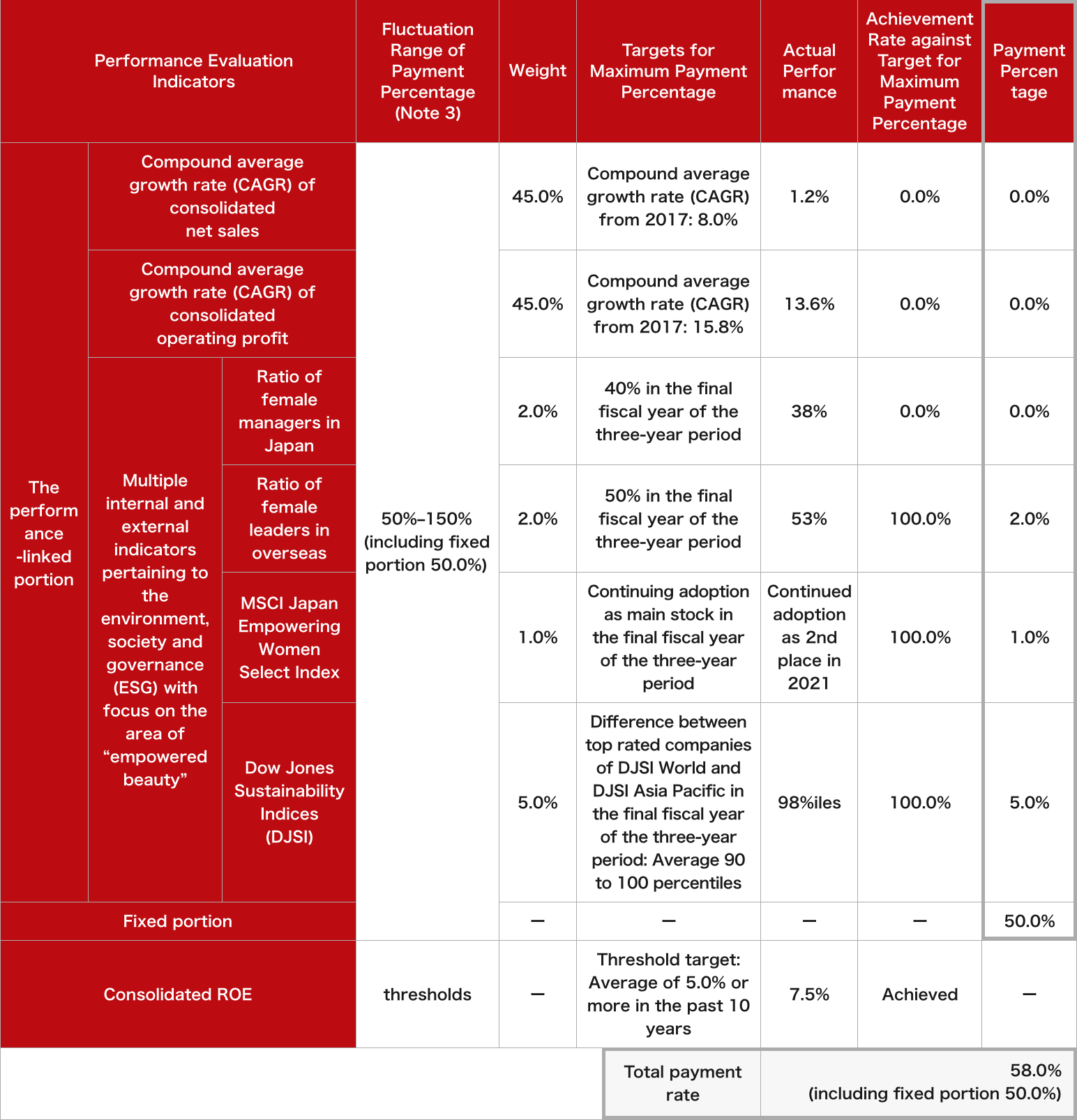

■ Performance-linked targets, actual performance and payment percentage, etc. of long term incentive-type remuneration granted for fiscal year 2020 and paid to Directors excluding External Directors

Notes :

- 1. The period of evaluation for the performance-linked stock remuneration (performance share units) granted for fiscal year 2020 is from January 1, 2020 to December 31, 2022.

- 2. As for performance evaluation indicators, from the perspective of creating corporate value from both aspects of economic and social values, the Company has adopted the compound average growth rate (CAGR) of consolidated net sales and the compound average growth rate (CAGR) of corporate operating profit as indicators related to economic value among corporate value, and the multiple internal and external indicators pertaining to the environment, society and corporate governance (ESG) as benchmarks on creation of social value.

- 3. Since the fixed portion (50%) is set, the fluctuation range of the total payment percentage, which is the sum of the fixed portion and the performance-linked portion, is from 50% to 150%.

- 4. Consolidated ROE is set as a benchmark for the Nomination & Remuneration Advisory Committee to discuss the notion of lowering the percentage amount of payment of the performance-linked portion in the event that consolidated ROE falls below certain thresholds set.

- 5. Of the performance evaluation indicators, the actual performance ratio of the ESG indicator is calculated by rounding off to the nearest whole number.

ABOUT US

- Regional Headquarters

BRANDS

- Prestige

- Inner Beauty

- Life Quality Beauty

- Quality Assurance

SUSTAINABILITY

- Materiality Core Activities

- Culture・Governance

- Data

INNOVATION

- Related Links

- Our Products Policy

- BEAUTY TECHNOLOGY LAB by Shiseido

CAREERS

INVESTORS

- IR Library